“Men may come and men may go, but I go on forever” is a famous line from the poem “The Brook”. I feel it is apt for CA profession. Governments might change, regulations may become stringent or loose-ended, economy might be booming or collapse, new industries might emerge and vanish all of a sudden and few shut down and so on.., whatever be thy, Role of a CA inspite and irrespective of the circumstances/situations is inevitable. It is an evergreen always in demand profession.CA is one of the well-paid and reputed professions in India and abroad. As Ratan TATA said, ”I need MBA for running my business.., But CA to teach them how to run the business”. Such is the weightage and value CA holds. Almost every panel has a CA who are the decision-makers, conceives the idea of the business, Structures, formulates and regulates the norms,

It is taken for granted that Chartered Accountants has sound business skills and numerical ability. Especially during their articleship training they gain their practical knowledge, have independence of thought, good communication skills, have industry understanding and the ability to work under the pressure of deadlines are some of the few magic potion. CAs are in high demand and can build their careers in umpteen ways.

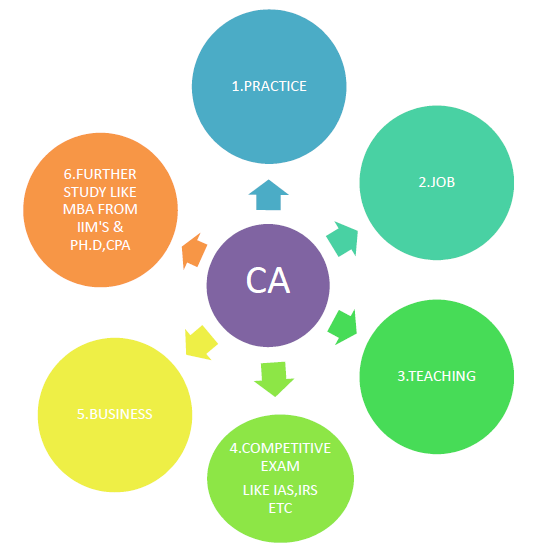

When it comes to career opportunities, there are wider opportunities for a Chartered Accountant.

- Own Practice/Consulting/Business /Govt Jobs/Work @ MNCs: Post qualification, one can either get into employment or start his own practice or become a consultant or follow his passion and start a business or do a combo of all!

- Career in Accounting and finance: In companies as financial controllers, CFO’s, Account Managers, Credit Managers, Internal Audit Department, Preparation of Financial Statements, Designing of Internal Finance Controls, Managing Treasury function, MIS Report Preparation

- Transfer Pricing

- Tax Audit, Advisory & Consultancy (Both Direct and Indirect) & International Taxation

- Statutory ,Internal ,Forensic Auditing

- GST Audit

- ROC/IT/GST return Filing

- Information Systems Audit

- Debt Syndication

- Project Finance

- Valuation, Equity Research, Asset Management, Portfolio Management

- Analyst, Strategist

2. Make a career in Stock Market

3. Entrepreneur: CA is a way of life. By the time you qualify, I’m sure you should have gone through a lot! Be it managing your classes & work, meeting deadlines, Self-motivating, patience, discipline etc…, Especially during CA final preparation I’m sure most of us have conceived lot of ideas. Give it a shot! A lot of CAs have given up their job and have joined the startup league. Some of the successful CA Entrepreneurs on large scale are ,

- Radhe Shyam Agarwal, Co-founder Emami

- Nirmal Jain, founder of India Infoline Group

- Sonia Singal launched recruitment portal for CAs

- Rajesh Magow, co-founder of MakeMyTrip

- Dhruv Shringi, co-founder & CEO Yatra Online

4. Teacher: Teaching is the noble profession. Having cracked one of the toughest course, who else can guide better than a CA himself!!Considering the complexity and voluminous of the curriculum, a large number of students take up classes. You can become a guide/mentor /Teacher or even start your own institute.

5. Financial Journalist/Author: If you are passionate about writing and love finance then, you can become a Financial journalist. If you could summarize the bare act into simple layman terms or you have a pattern to complex tricky problems, you could author books.

6. Mergers and Acquisitions

7. Software Development: If you have the technical brilliance and domain knowledge and a bit tech-savvy, then you should consider developing customized software to ease of complexity. Can explore opportunities with SAP teams, Oracle, ERP, develop a customized AI. With Ind AS being rolled and amendments being made, become the expert, try to develop a tool which meets the standards. Tally ERP is one such example, which was developed by a CA

8. International opportunities: CAs are in high demand in UAE, Singapore, Australia. ICAI is taking every possible effort by setting higher standards, by signing MOUs with different countries.

Having taken through the some of the many opportunities, would like to draw your attention that, these opportunities would vary depending upon you, Major contributory as follows,

- Articleship training does play a major role, the exposure you gain ,area of interest, does contribute majorly

- how you have equip yourself over the period of study -Learning new principle

- Domain knowledge

- Technical Brilliance

As quoted by Kumar Mangalam Birla,” The golden rule I can think of is the fact that you must follow your passion and do something that’s close to your heart” and this course is one such course you become a professional, at the same time you could follow your passion The demand for CAs are ever growing and the opportunities are widening and It is the most rewarding course. According to the United States Bureau of Labor Statistics(BLS) in May 2020,the average pay for accountants and auditors was $73560.Maybe the path to become a CA is a bit rough but post qualification it is studded with diamonds. Opportunities are many, it’s about how you position yourself

Next Read: What are the CA Final Elective Papers and which one to choose? »